Maximize Your Savings With a Federal Cooperative Credit Union

Checking out the globe of Federal Debt Unions for maximizing your financial savings can be a strategic monetary step worth thinking about. The advantages, ranging from greater rates of interest to customized cost savings choices, provide an engaging chance to reinforce your economic health and wellness. By understanding the alternatives and benefits offered, you can make informed choices that straighten with your savings goals. Allow's dig right into the subtleties of maximizing your cost savings potential through the unique offerings of a Federal Debt Union and just how it can pave the method for an extra secure economic future.

Advantages of Federal Lending Institution

Federal Credit rating Unions are guaranteed by the National Credit Report Union Administration (NCUA), providing a similar level of defense for deposits as the Federal Down Payment Insurance Coverage Firm (FDIC) does for financial institutions. Overall, the advantages of Federal Credit rating Unions make them a compelling choice for people looking to maximize their savings while getting personalized solution and assistance.

Subscription Eligibility Requirements

Membership eligibility standards for Federal Cooperative credit union are developed to regulate the credentials people must fulfill to come to be participants. These requirements make sure that the cooperative credit union's membership stays unique to people that meet details requirements. While eligibility criteria can vary somewhat between different Federal Cooperative credit union, there are some typical aspects that candidates may come across. One regular requirements is based upon the person's location, where some cooperative credit union serve particular geographic areas such as a certain neighborhood, company, or organization. This helps create a sense of community within the cooperative credit union's membership base. In addition, some Federal Cooperative credit union may require individuals to belong to a specific profession or sector to be eligible for membership. Household relationships, such as being a relative of a present participant, can additionally frequently work as a basis for subscription qualification. Comprehending and satisfying these requirements is vital for individuals aiming to sign up with a Federal Cooperative credit union and make use of the financial advantages they offer.

Interest-bearing Accounts Options Available

After determining your qualification for membership at a Federal Credit History Union, it is vital to check out the different cost savings account options readily available to optimize your economic benefits. Federal Credit history Unions commonly supply an array of financial savings accounts tailored to meet the varied needs of their see this participants.

An additional preferred option is a High-Yield Interest-bearing Accounts, which uses a higher interest rate compared to normal interest-bearing accounts. This kind of account is ideal for participants wanting to make much more on their financial savings while still preserving adaptability in accessing their funds. In addition, some Federal Credit rating Unions give customized interest-bearing accounts for specific financial savings goals such as education and learning, emergencies, or retirement.

Tips for Conserving Much More With a Cooperative Credit Union

Looking to enhance your cost savings potential with a Federal Credit Rating Union? Below are some ideas to help you conserve better with a lending institution:

- Benefit From Greater Rate Of Interest Prices: Federal Cooperative credit union usually supply higher interest rates on savings accounts compared to conventional financial institutions. By transferring your funds in a lending institution savings account, you can gain more rate of interest with time, assisting your cost savings expand quicker.

- Explore Different Cost Savings Products: Credit report unions use a selection of cost savings products such as certificates of down payment (CDs), cash market accounts, and specific retired life accounts (IRAs) Each item has its own advantages and functions, so it's necessary to explore all options to locate the most effective fit for your savings objectives.

- Set Up Automatic Transfers: Schedule automatic transfers from your checking account to your lending institution interest-bearing account. This means, you can continually add to your savings without having to believe about it regularly.

Comparing Cooperative Credit Union Vs. Standard Bank

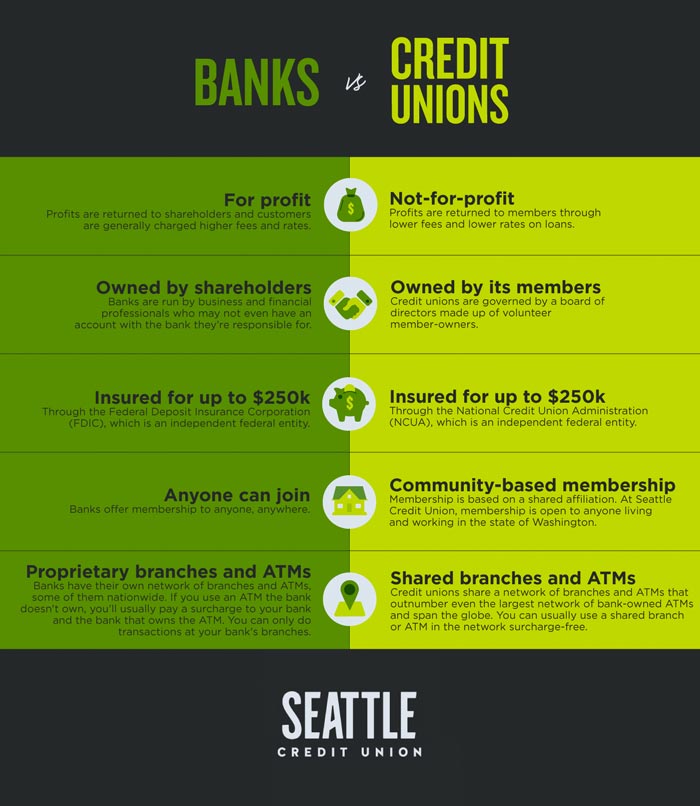

When assessing banks, it is necessary to consider the distinctions in between credit report unions and conventional financial institutions. Cooperative credit union are not-for-profit companies had by their participants, while traditional financial institutions are for-profit entities owned by shareholders. This essential difference frequently translates right into much better passion prices on cost savings accounts, reduced financing prices, and fewer costs at cooperative credit union compared to financial institutions.

Debt unions usually offer an extra customized technique to banking, with a concentrate on neighborhood involvement and participant satisfaction. On the other hand, traditional financial institutions might have an extra substantial variety of areas and solutions, but they can sometimes be perceived as less customer-centric due to their profit-oriented nature.

Another trick distinction remains in the decision-making procedure. Lending institution are controlled by a volunteer board of supervisors chosen by members, guaranteeing that decisions are made with the ideal rate of interests of the participants in mind (Credit Unions Cheyenne). Standard financial institutions, on the other hand, operate under the instructions of paid shareholders and executives, which can occasionally cause decisions that focus on profits over customer benefits

Inevitably, the choice in between a credit rating union and a conventional financial institution relies on private preferences, monetary goals, and financial requirements.

Final Thought

To conclude, taking full advantage of savings with a Federal Credit Union supplies many advantages navigate to these guys such as greater interest rates, lower financing rates, reduced charges, and exceptional customer support. By capitalizing on different interest-bearing account options and checking out different savings items, people can customize their financial savings strategy to fulfill their financial check out here objectives efficiently. Selecting a Federal Lending Institution over a traditional financial institution can bring about greater financial savings and economic success in the future.

Federal Credit scores Unions are guaranteed by the National Credit Rating Union Management (NCUA), providing a similar degree of security for deposits as the Federal Deposit Insurance Coverage Company (FDIC) does for financial institutions. Credit Unions Cheyenne.After identifying your eligibility for membership at a Federal Credit Report Union, it is important to discover the different financial savings account choices offered to optimize your economic advantages. Additionally, some Federal Credit history Unions supply specific cost savings accounts for specific financial savings objectives such as education and learning, emergency situations, or retired life

By depositing your funds in a debt union savings account, you can make more rate of interest over time, assisting your financial savings grow quicker.

Explore Different Savings Products: Credit rating unions provide a range of savings products such as certifications of deposit (CDs), money market accounts, and private retirement accounts (Individual retirement accounts)

Comments on “Explore Top Credit Unions in Cheyenne: High Quality Financial Solutions”